50/30/20 Budget Rule: The Simple Way to Save More Money

💰 What is the 50/30/20 Budget Rule?

Hey there! Have you ever felt like managing your money is just too complicated? You're definitely not alone! That's why I'm super excited to tell you about the 50/30/20 budget rule - it's honestly been a game-changer for so many people who want to save more without feeling restricted.

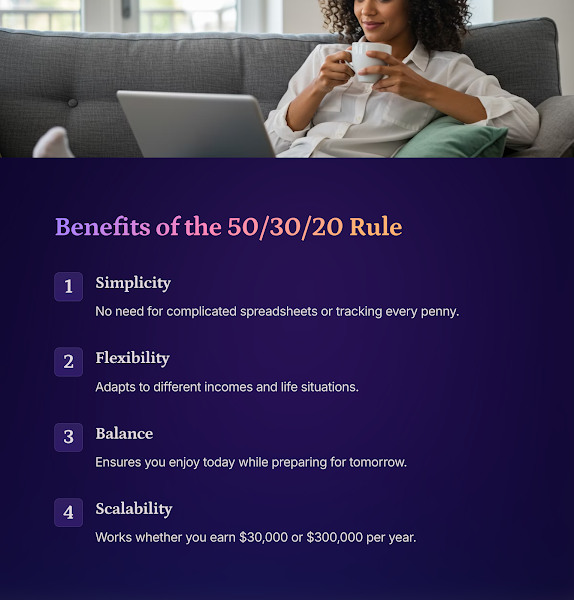

The 50/30/20 rule is exactly what it sounds like - a super simple way to divide up your after-tax income into just three categories. No complicated spreadsheets or tracking every single penny required!

Here's the breakdown: you allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. That's it! This approach was popularized by Senator Elizabeth Warren in her book "All Your Worth," and it's stuck around because it's both flexible and effective.

What makes this rule so awesome is that it gives you a framework without being super rigid. It acknowledges that yes, you need to have some fun in life (that's the 30% wants category!), while still making sure you're building financial security.

| Budget Category | Percentage |

| Needs | 50% of after-tax income |

| Wants | 30% of after-tax income |

| Savings & Debt | 20% of after-tax income |

Let's say you bring home $4,000 a month after taxes. Using this rule, you'd allocate $2,000 to needs, $1,200 to wants, and $800 to savings and debt repayment. Pretty straightforward, right?

In the rest of this post, I'll break down each category in more detail, show you how to adapt this rule to your specific situation, and give you some practical tips to get started right away. Trust me, this could be the budget system you've been looking for!

🏠 The 50% - Understanding Your Needs

Let's talk about that 50% chunk of your budget that goes toward needs. These are the must-haves - the expenses you really can't avoid. The key is figuring out what's truly a need versus what might actually be a want in disguise!

Your needs typically include things like housing, groceries, utilities, insurance, minimum debt payments, and transportation to work. Basically, if not paying it would seriously impact your health, safety, or ability to work, it's probably a need.

One thing that trips people up is housing costs. In some expensive cities, keeping housing under 50% can feel almost impossible! If you're finding that your needs are taking up way more than half your income, don't get discouraged. This might be a sign that you need to make some bigger changes, like looking for a roommate, finding a less expensive place, or even considering a move to a more affordable area.

🧠 Here's a smart tip: review your "needs" regularly because some sneaky wants might be hiding in there! For example, do you really need the premium cable package, or the most expensive cell phone plan? Could you get by with a more affordable car?

Also, keep in mind that while minimum debt payments count as needs, paying extra on your debts would fall into the savings/debt repayment category. This distinction helps you see clearly how much of your money is going to absolute essentials.

If your needs are currently more than 50% of your take-home pay, don't worry! You can work toward this goal gradually. Even small adjustments to your fixed expenses can make a big difference over time.

| Housing | Groceries | Utilities |

| Healthcare | Transportation | Insurance |

| Childcare | Minimum Debt Payments | Basic Clothing |

| Internet/Phone | Prescription Medications | Work Expenses |

🛍️ The 30% - Managing Your Wants

Now for the fun part - your wants! This 30% category is what makes the 50/30/20 rule feel so doable compared to other budgeting methods. It acknowledges that we're human and need some joy and fun in our lives!

What counts as a want? Basically, anything you could technically live without: dining out, streaming services, vacations, hobbies, shopping for non-essential clothes, concert tickets, that daily coffee shop visit... you get the idea!

The beauty of setting aside a specific amount for wants is that it gives you permission to enjoy life without guilt. When you know you've already taken care of your needs and savings goals, you can spend this money freely on whatever makes you happy.

🌟 One cool approach is to think of your "wants" budget as your "happiness budget." Research shows that spending money on experiences often brings more lasting happiness than buying material things. Maybe you'd rather have fewer clothes but take that weekend trip with friends!

Sometimes the line between wants and needs can get blurry. For example, you need food (a need), but you don't need to eat at restaurants (that's a want). You need a phone (probably a need in today's world), but you don't need the latest model with all the bells and whistles.

If you're trying to save more money or pay down debt faster, the wants category is usually the easiest place to make cuts. Even reducing it temporarily to 20% or 25% of your income can speed up your progress toward other financial goals.

Remember, the goal isn't to eliminate all wants - that's not sustainable! The goal is to make conscious choices about what you value most and spend accordingly, rather than mindlessly buying things that don't really add much joy to your life.

💵 The 20% - Growing Your Savings

This might be my favorite part of the 50/30/20 rule - the 20% that goes toward building your future! This category covers both saving money and paying down debt beyond the minimum payments.

Why 20%? Well, most financial experts agree that saving at least 20% of your income is a solid target for long-term financial health. It's enough to build your emergency fund, save for retirement, and work toward other big financial goals like buying a home or funding your kids' education.

If you're carrying high-interest debt (like credit cards), it usually makes sense to focus on paying that down first before building up lots of savings (beyond a small emergency fund). The interest on that debt is probably way higher than what you'd earn on your savings!

🔄 Here's a simple order of priorities that works well for most people:

1. Build a small emergency fund of about $1,000 to handle minor emergencies

2. Pay off high-interest debt (typically anything over 6-8%)

3. Increase your emergency fund to cover 3-6 months of essential expenses

4. Save for retirement (especially if your employer offers matching contributions!)

5. Save for other goals and/or pay down lower-interest debt

The awesome thing about consistently saving 20% is how quickly it adds up! If you're earning $50,000 after tax, that's $10,000 a year going toward improving your financial situation. Over ten years, that's $100,000 plus all the interest or investment returns!

If saving 20% feels completely impossible right now, start smaller - even 5% or 10% is so much better than nothing! You can gradually increase your savings rate as your income grows or as you find ways to reduce your needs and wants.

Remember, the point of saving isn't just to have money sitting around - it's to build security and freedom for your future self. Your savings are literally buying you options and peace of mind!

🚀 Getting Started with the 50/30/20 Rule

Ready to give the 50/30/20 budget a try? Let's break down how to get started in some super easy steps!

First, figure out your after-tax income - that's the amount that actually hits your bank account after taxes and other deductions like health insurance or retirement contributions. If you're self-employed, you'll need to subtract your estimated tax payments.

Next, track your spending for about a month to see where your money is currently going. You can use a budgeting app, a spreadsheet, or even just a notebook. The important thing is to capture everything so you have a clear picture.

Now for the fun part - categorize those expenses into needs, wants, and savings/debt repayment. Be honest with yourself about what's truly a need versus a want!

Once you've categorized everything, calculate what percentage of your income is currently going to each category. This will show you where adjustments might be needed.

🔍 Don't be surprised if your current spending doesn't match the 50/30/20 breakdown! Most people find they need to make some changes, especially at first. The most common issue is spending too much on wants and not enough on savings.

If your current spending is way off from the ideal percentages, don't try to fix everything at once. Pick one or two expenses to adjust and gradually work toward the 50/30/20 goal over a few months.

Consider setting up automatic transfers for your savings as soon as you get paid. This "pay yourself first" approach makes it much easier to stick to your savings goals because the money is already tucked away before you can spend it.

Remember that this system is flexible! If you live in an area with a super high cost of living, you might need to adjust to something more like 60/20/20. The important thing is to have a plan that works for your specific situation while still prioritizing saving.

✨ Why This Budget System Really Works

I hope by now you can see why the 50/30/20 rule has become so popular! Unlike complicated budgeting systems that have you tracking dozens of categories, this approach is refreshingly simple while still being effective.

The biggest advantage is that it's flexible and realistic. It doesn't expect you to track every single penny or deny yourself all pleasures. Instead, it gives you a framework that acknowledges both your current needs and your future goals.

Another huge benefit is that this system grows with you. As your income increases, you can maintain the same percentages and automatically save more while also enjoying more wants - without lifestyle inflation consuming all your raises!

🌈 Remember that the 50/30/20 rule is a guideline, not a rigid set of rules. The important thing is that you're thinking about your spending intentionally and making progress toward your financial goals. Some months might look different than others, and that's totally okay!

| What if my needs are more than 50% of my income? | This is actually pretty common, especially in high-cost areas or with lower incomes. Start by examining if any "wants" have snuck into your "needs" category. Then look for ways to reduce fixed costs over time, like getting a roommate or refinancing loans. In the meantime, adjust your percentages to something more realistic for your situation, like 60/20/20. |

|---|---|

| Should I include my 401(k) contributions in the 20% savings? | Yes! Any money you're setting aside for the future counts toward your 20% savings goal. This includes retirement contributions, emergency fund savings, and extra debt payments beyond the minimums. If your employer automatically deducts retirement contributions from your paycheck, you can count this toward your 20%. |

| Can I still use the 50/30/20 rule if I'm trying to pay off a lot of debt? | Absolutely! In fact, this system works really well for debt repayment. Your minimum debt payments go in the "needs" category, and any extra payments you make fall into the "savings/debt repayment" 20%. You might even want to temporarily shift some of your "wants" money to debt repayment to speed up the process. |

I hope this guide helps you implement the 50/30/20 budget rule in a way that works for your life! Remember, the goal isn't perfection - it's progress. Every step you take toward better money management is a win, and over time, these small wins add up to major financial strength.

Have you tried the 50/30/20 budget before? I'd love to hear about your experience in the comments below!

Comments

Post a Comment